Doctor Genius designed content ignition packages (CIPs) to boost client ranking and provide supplemental content for users on their sites. Our team at DG reviews and studies the CIP’s ranking data to ensure performance meets or exceeds client expectations. This is why we put together quarterly reviews of the data on CIPs, appraising how they impact ranking. The reviews are then shared with our clients. In this blog, we share what is discussed with clients during a quarterly review.

Proven Results From CIP Deployment

We use the Doctor Genius Portal, Google Analytics, Google My Business (GMB), and Google Search Console (GSC) to accurately analyze data on content ignition packages and service page content throughout the program. These tools allow us to distinguish increased ranking due to CIP deployment or service pages. Then, after analyzing the data, we can determine the best choice of keywords, blogs, and service pages for a particular client. During the quarterly reviews, we go over data and make recommendations to the client.

Example Case Study

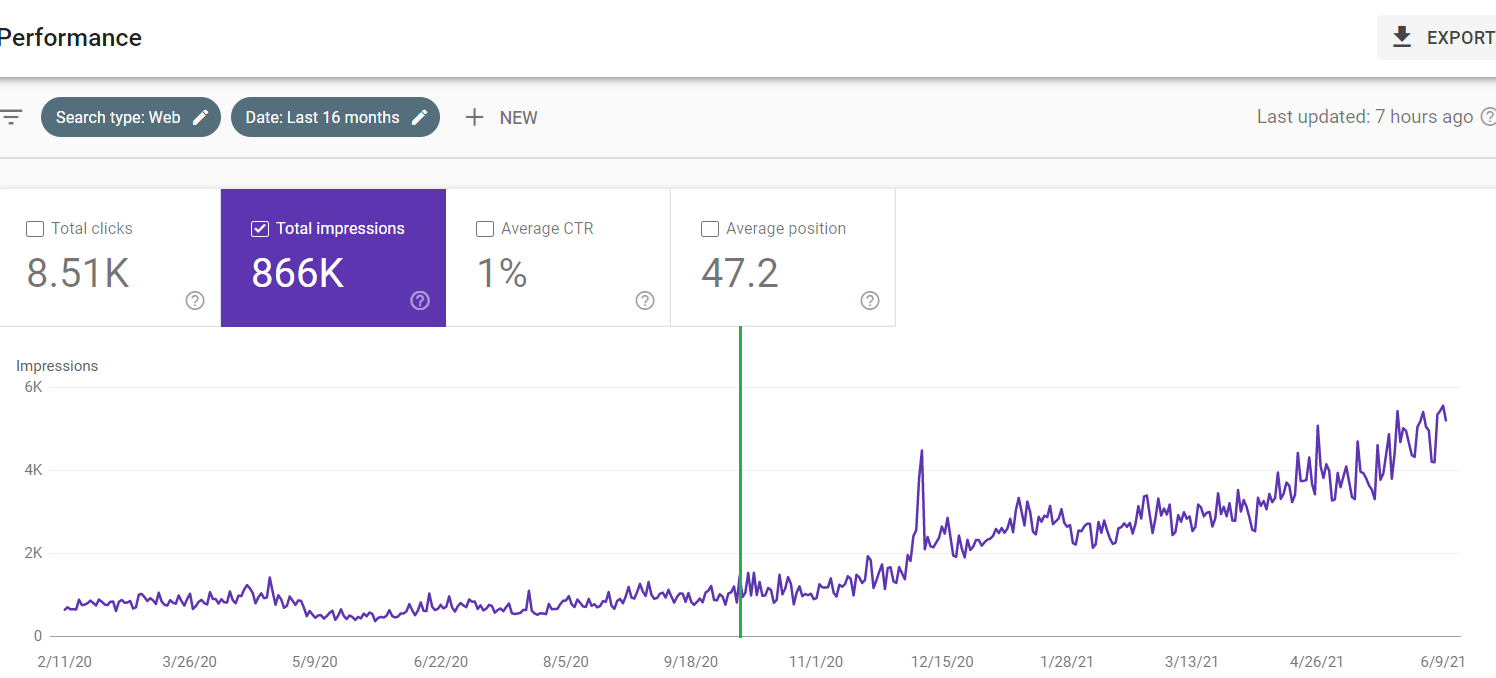

The chart below provides the performance data for a particular client and the information we obtain for any given site: total clicks, total impressions, average CTR (click-through rate), and average position (average ranking compared to competitors). Total clicks report the number of times a consumer clicks on the site link, whether or not they are taken to the website or not. Total impressions refer to the number of times the site appears on a search engine page.

As seen in the chart, online visibility as measured by impressions increased for this client after installing a content ignition package. However, it’s important to note that this client also upgraded from Gold to Platinum. This upgrade gave the client 109 new blogs between October 13 and June 16, of which 70 were specifically CIP blogs. Therefore, we can safely assume at a minimum that 40-50% of the ranking increase was from CIPs alone, excluding the 50-60% from additional content added from the service upgrade and the KCP launched simultaneously (to learn about KCPs, or keyword content package, check out this blog here).

The green line indicates when the client upgraded to a higher tier and not the date the first blog in the CIP went live about two months later. Therefore, it is important to note that the real effect of the data took place over the roughly six-month period between mid-December and mid-June. You’ll also notice a large spike that occurred when a cluster of content was added all at once. The uptick that began in late December follows the CIP deployment more closely.

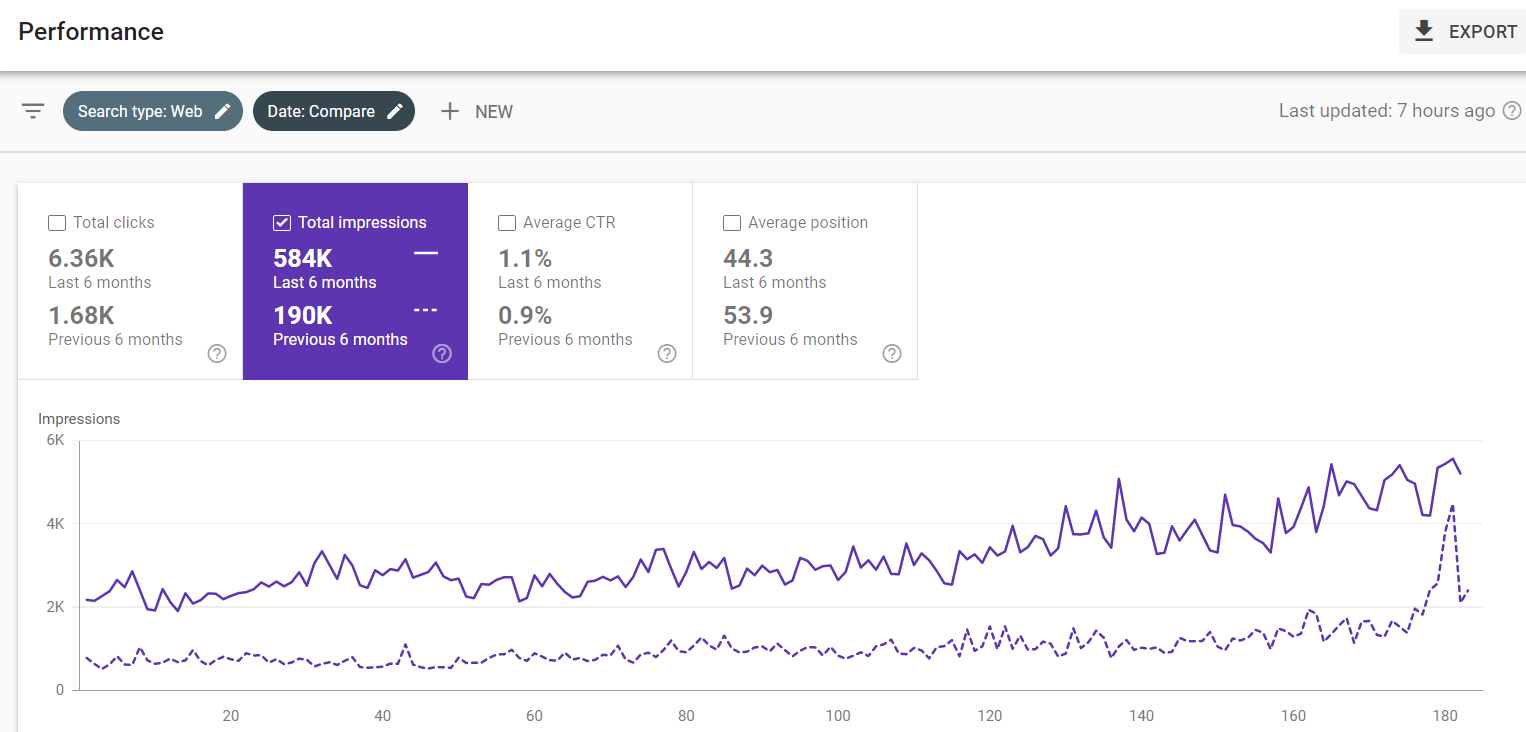

The data performance page compares the total clicks, total impressions, the average click-through rate, and the average position compared to the previous six months. It is important to note that the peak in December is fairly typical because there are usually a few weeks around the end of the year when medical searches spike, altering the data more greatly when they happen in conjunction with new content being added. The increase in total impressions was a combination of the newly implemented update as well as the deployment of the CIP and KCP.

The green line is when CIP v2 was deployed over 6 months.

The CIPs’ influence on ranking can be understood by putting the total increase in impressions and the average increase in impressions into meaningful data points. As described, the cadence (frequency at which the blogs are published) is greater for the CIPs than KCPs, indicating that they likely had a greater influence over the total uptick in ranking. Therefore, we can estimate that CIPs for the client, illustrated in the data below, increased the total impressions by 175-300% over six months. This growth can also be observed from an average of 1,200 impressions/day to closer to 5,000 impressions/day just eight months later. Since the average daily impressions increased steadily, we can conservatively attribute ½-¾ of the daily average increases to the CIPs. That means the CIPs more than doubled average daily impressions from before launching or increased daily impressions by 1300-2550.

The current 6 month period (top) vs the previous 6 month period (bottom) and the gains in impressions relative to a keyword.

Performance Reviews

We hold performance reviews for our Gold-tier clients and higher every quarter. During a performance review, we go over their campaign performance, illustrate the numbers and what they mean, and answer any questions they may have about the previous or current progress.

The purpose of performance reviews is to determine what is working and what is not. Together, we look at GMB insights, analytics, and impressions to identify what search terms, service pages, and blogs perform well. We then determine if a CIP deployment could improve the numbers if they are not meeting expectations or if the client would like to embark on a service to boost already well-performing content. It’s important to note that we also hold these reviews if a CIP has been deployed, using the same sources to measure changes in performance.

We craft the next quarter’s goals based on the client’s questions, concerns, and desired outcomes relative to the available data from previous quarters. This includes working keywords, new keywords to deploy, additional CIPs and KCPs, and any recommendations deemed fit for that client.

First Quarter Review

We take a deep dive into the client’s site performance during the first quarter review, discussing in detail the first three months. We’ll review the services and products that were deployed and how they enhanced the site’s ranking while going over how additional services may increase performance even further.

We will also look into how the CIPs are performing using Search Console and Google Analytics. Early signs of highly-performing services include increased impressions, improved analytics, or any obvious New Patient Inquiry (NPI) jumps in their portal. This helps explain how the CIP and KCP deployed are increasing performance or whether they should be altered in the next quarter.

Using the acquired data and discussion with the client, we can set the stage for the next quarter. This involves looking at the quarter’s goals, objectives, and desired outcomes. We check the KCP or CIP planned for deployment and ensure that all content is written, the Hub and four sub-pages are complete, and our first blogs of the KCP are ready to launch.

Planning the next quarter’s goals means that the site would then be live for six months, enough time to expect an increase in NPIs, improved data across the GMB performance page, verifiable site engagement, and new patients acquired online.

After six months, the CIP V2 will be fully deployed and the KCP well on its way. By this point, we should have enough data to identify any emerging trends or keywords that are gaining traction by looking at queries in the GSC or screening by page. We then decide what CIP from our library we will deploy next and likely pair that with an emerging or rising keyword. Platinum clients receive a new CIP every quarter, which will allow them access to the most prominent keywords every few months.

At the end of the review, we will make any recommendations we deem necessary or fitting for each client and their site. We will illustrate what each proposal would entail, the benefits, and the desired outcomes. Clients who choose to initiate any changes or upgrade their services can see those changes enacted immediately and may gain those desired outcomes sooner than later.

Second Quarter and Beyond

The second and subsequent quarter reviews begin the same as the first quarter review in that we go over what worked and the desired outcomes for the current and future quarter. During these reviews, however, we dive into the data faster as the client can more readily interpret what the data indicates by this point. Therefore, we typically spend the bulk of the meeting reviewing expected results and benchmarks outlined in the first quarter review.

In the second quarter review, we are setting the stage for three months ahead with goals and outcomes outlined for the 6-month mark. We may suggest moving the campaign to the next tier in order to establish agreeable terms and reach their goals. Lastly, we will review the next keyword-specific CIP of choice to be deployed based upon the GMB and GSC data. Each subsequent quarterly review will mirror the second quarter review.

Get Started or Upgrade Today

Give your site a jumpstart today by incorporating a content ignition package or keyword content package for a targeted keyword in your field. CIPs tell Google that a practice is an authority source as it interprets a website that frequently posts on a subject to be knowledgeable in that subject. In turn, the package not only increases the likelihood that your practice will be found through a search engine, but it also provides more information to educate patients on their health. Whether or not CIPs meet your needs, we are here to help you plan out a campaign that works best for your practice. Our SEO specialists and customer experience teams work together to create and maintain a high-performing site that drives customers to our clients, whether online or to their door. Call us today for a free demo or to learn more about our plans and services and launch your site as soon as a few months!

Doctor Genius, located at 16800 Aston Street, Suite 270, Irvine, CA 92606, provides a range of services for practice success. We seek to meet our clients’ needs by providing a variety of marketing, SEO, practice optimization tools, and coaching to transform the healthcare experience. Though we work to provide the most accurate information, the content found on this website is solely intended for entertainment purposes. Therefore, we cannot guarantee that the information provided is entirely correct. You may not use the information on this site to cure, prevent, or diagnose a perceived medical issue. If you have healthcare-related needs, please speak directly to a healthcare professional. Never self-perform medical treatments discussed on this website. All images displayed are also for entertainment purposes only, and personal experiences may differ. Please note that the business tactics mentioned on this site might not be applicable to your industry or practice.